Exploring PadiePal: A Comprehensive Neo Banking Solution for Your USD Banking Needs

- FinancePadiepal

- December 2, 2024

- No Comment

- 73

Introduction to Neo Banking

Neo banking represents a significant evolution in the financial services sector, diverging from traditional banking models by leveraging technology to enhance user experience. Unlike established banks that operate with legacy systems and physical branches, neo banks are entirely digital, allowing for a seamless, efficient banking experience that aligns with modern consumer preferences. These digital-first financial institutions typically offer a suite of services including checking and savings accounts, loans, and payment processing, all accessible through user-friendly mobile applications.

The rise of digital banks can be attributed to the growing reliance on technology and the increasing demand for convenience among consumers. Traditional banking often involves tedious processes such as lengthy paperwork and in-person visits, which can be a barrier for today’s tech-savvy populace. In contrast, neo banks focus on streamlining these processes, enabling customers to open accounts, transfer money, and access services with just a few clicks. This shift not only saves time but also empowers users with real-time updates on their financial activities.

Furthermore, the concept of fintech, or financial technology, serves as a critical backdrop for understanding neo banking. Fintech encompasses a range of applications that harness technology to improve and automate the delivery of financial services. Neo banks capitalize on this trend by employing advanced algorithms and data analytics to provide tailored products and services that resonate with customer needs. This paradigm shift has resulted in greater financial inclusivity, as many neo banks prioritize accessibility for underserved populations by eliminating high fees and minimum balance requirements.

As neo banking continues to gain traction, it stands to significantly alter the landscape of personal finance, catering specifically to the preferences of the digitally inclined consumer. By embracing innovation and prioritizing user-centric solutions, neo banks like PadiePal are redefining how individuals manage their financial lives.

What is PadiePal?

PadiePal is an innovative neo banking service tailored specifically for individuals and businesses seeking efficient solutions for their United States Dollar (USD) banking requirements. As a pioneer in the realm of digital banking, PadiePal offers a user-friendly platform designed to simplify transactions and enhance financial management. Its mission centers around providing accessible and seamless banking experiences that cater to a diverse audience, including expatriates, digital nomads, freelancers, and international businesses.

Founded in response to the evolving financial landscape, PadiePal has quickly established itself as a significant player among neo banks. The founders recognized a gap in traditional banking systems, which often failed to serve modern consumers who prioritize convenience and technological integration. This foresight laid the groundwork for a platform that not only meets the demand for USD banking services but also pushes the boundaries of user experience.

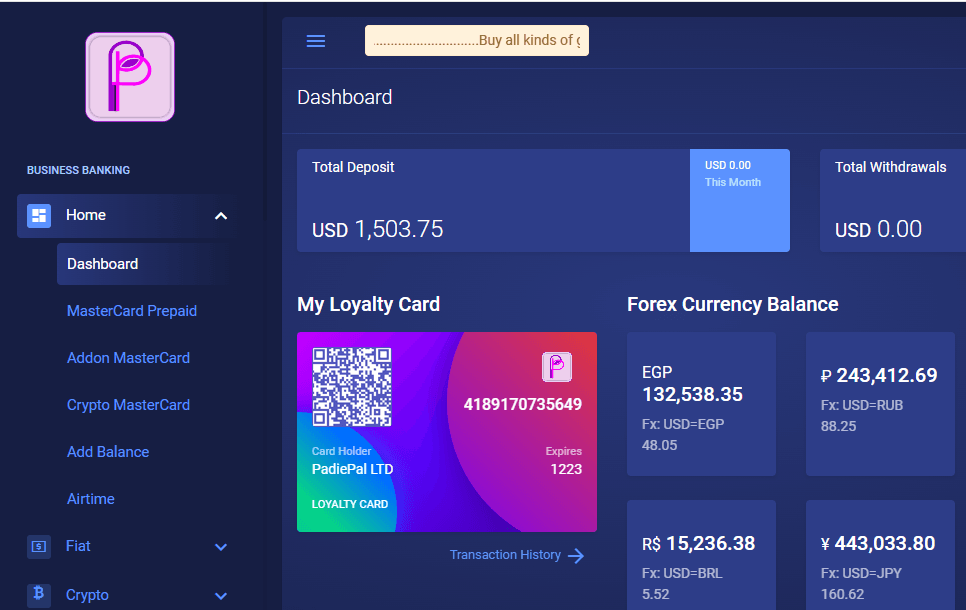

Key features of PadiePal include instant account setup, low transaction fees, and advanced security measures, ensuring that users can manage their finances with peace of mind. Furthermore, it offers innovative tools for budgeting and expense tracking, thereby empowering users to take control of their financial health. The platform also supports a variety of currencies, reflecting its commitment to serving a global audience, while still focusing on the unique needs surrounding USD banking.

In an era where digital solutions are increasingly favored, PadiePal represents a compelling alternative to traditional banking. Its growth trajectory highlights a significant shift in consumer preferences, making it particularly relevant in the context of the current banking landscape. As more users transition to digital platforms, PadiePal stands poised to redefine how individuals and businesses engage with their banking needs.

Key Features of PadiePal Neo Banking Services

PadiePal offers a range of innovative features designed to meet users’ USD banking needs. One of the most appealing aspects of this neo banking solution is its streamlined account setup process. Users can easily create an account through the PadiePal mobile application, eliminating the lengthy procedures often associated with traditional banks. The intuitive interface guides users through the registration steps, making it accessible even for those with limited banking experience.

The mobile app functionality is another highlight, providing users with a comprehensive banking experience in the palm of their hand. The application is designed to offer real-time transaction notifications, allowing users to stay informed about their account activities. Additionally, the app’s features allow for efficient fund transfers, including peer-to-peer payments and international remittances, ensuring that users can manage their finances seamlessly, whether at home or abroad.

PadiePal also differentiates itself with its savings account options. Users can easily open a savings account that offers competitive interest rates, empowering them to grow their funds over time. The platform’s automated savings features enable users to set aside funds based on their unique financial goals, fostering better money management practices.

Furthermore, PadiePal’s loan offerings are tailored to cater to diverse financial needs. Whether users are seeking personal loans or business financing, the application integrates a straightforward application process, allowing for quick approvals and disbursements. This aspect is especially beneficial for those requiring prompt financial support.

Lastly, customer support services are prioritized at PadiePal. The dedicated support team is available via various channels, including live chat and email, ensuring that assistance is readily accessible when users encounter challenges or have inquiries. This commitment to customer satisfaction enhances the overall banking experience, making PadiePal a reliable choice for USD banking needs.

Benefits of Using PadiePal for USD Banking

When it comes to banking in USD, PadiePal offers a range of benefits that cater to both individual users and businesses. One of the most significant advantages is the reduction in fees typically associated with traditional banking services. With PadiePal, users can enjoy lower transaction fees, which can lead to substantial savings over time, especially for those who engage in frequent financial activities.

Convenience is another key factor that makes PadiePal an attractive option for USD banking. The platform is user-friendly and accessible through various devices, allowing customers to manage their accounts anytime and from anywhere. This level of accessibility is particularly beneficial for international users who need to transact in USD. Whether sending money, paying bills, or transferring funds, users appreciate the seamless experience that PadiePal offers.

Speed is crucial in today’s fast-paced financial environment. PadiePal facilitates faster transactions, which means funds are available almost instantly for many transactions. This quick processing can be particularly advantageous for those who need to make critical payments or transfers without delay. The immediacy of transactions enhances cash flow for businesses and allows individuals to manage their finances more effectively.

Security is a vital concern for any banking solution, and PadiePal addresses this with advanced security measures. Users can expect multi-factor authentication, encryption technology, and constant monitoring of their accounts. This commitment to security provides peace of mind, allowing customers to focus on their financial transactions without undue worry.

Moreover, PadiePal supports international transactions, enabling users to send and receive USD globally with ease. This feature is invaluable for expatriates or businesses engaged in cross-border transactions, providing them with a reliable platform for managing their USD banking needs.

In the real world, users have reported enhanced satisfaction and efficiency when using PadiePal, citing specific instances where they saved money on fees and expedited important transactions. Overall, the benefits offered by PadiePal make it a strong contender in the neo banking landscape for those looking to manage their USD banking needs effectively.

Comparison with Traditional Banking Systems

In evaluating the efficacy of PadiePal as a neo banking solution, it is essential to compare it against traditional banking systems. One of the most prominent differences lies in the fee structure. Traditional banks often impose a myriad of fees, including monthly maintenance fees, ATM withdrawal charges, and overdraft fees. In contrast, PadiePal typically offers a more streamlined and transparent fee schedule, with far fewer charges. Users can benefit from low or even no fees for various transactions, enhancing their overall banking experience.

Another crucial factor for comparison is the range of services available. Traditional banks often provide a comprehensive suite of services, including loans, mortgages, and investment accounts. However, many of these services come with lengthy application processes and stringent requirements. PadiePal, while primarily focusing on USD banking solutions, embraces modern digital banking strategies, offering essential services such as digital wallets, real-time transactions, and currency exchange—services that are designed to cater to a tech-savvy customer base. This alignment with contemporary banking needs sets PadiePal apart from its traditional counterparts.

Customer service quality is another area where the differences between PadiePal and traditional banks become evident. Many customers report long wait times and impersonal experiences when dealing with established banking institutions. PadiePal enhances user experience through digital support features, including chatbots and dedicated customer service representatives available through mobile apps. This ensures quick resolutions to customer inquiries, further positioning PadiePal as a more accessible and user-centered option.

Finally, transaction speeds play a critical role in the banking experience. Traditional banking transactions, such as check deposits and fund transfers, often take several days to clear. On the other hand, PadiePal leverages technology to facilitate near-instantaneous transactions, allowing users to manage their finances with greater flexibility and efficiency. Overall, the comparison demonstrates how PadiePal effectively meets and often exceeds the expectations set by traditional banking systems.

User Experience and Customer Feedback

PadiePal has been designed with the user in mind, facilitating a seamless and intuitive banking experience. Users frequently highlight the platform’s straightforward navigation as a significant advantage, allowing even those unfamiliar with digital banking to manage their finances efficiently. Many testimonials commend the clean interface and well-organized layout, which promotes ease of access to key functions such as money transfers, account management, and budgeting tools. Such user-centric design reflects PadiePal’s commitment to creating an accessible neo banking solution.

Customer feedback particularly emphasizes the speed and reliability of transactions. Many users express satisfaction with the prompt processing of their deposits and withdrawals, alongside effective currency exchange options. This efficiency has led to high ratings in user surveys regarding transaction experiences. However, some customers have reported occasional issues with transaction limits and delays, signaling areas that may require further optimization to enhance user experience.

Customer support is another critical aspect of the PadiePal experience. Reviews suggest that the company’s support team is responsive and knowledgeable, with many users praising the quick turnaround time for resolving issues. Positive experiences have been shared regarding the live chat feature, which many users found courteous and helpful. Conversely, there are instances where users found the support resources lacking in depth, particularly concerning self-help documentation. These mixed reviews highlight the necessity for PadiePal to continually improve its customer service offerings.

Overall, the user experience with PadiePal appears to be largely positive, marked by intuitive navigation and efficient transaction capabilities. However, it is equally essential to address the concerns raised by users regarding support and occasional transaction hiccups. Striking a balance between user feedback will allow PadiePal to further enhance its neo banking services.

Security Measures in PadiePal Transactions

In the realm of neo banking, security is of utmost importance, and PadiePal prioritizes safeguarding users’ data and transactions through a robust array of security measures. One of the primary methods employed is advanced encryption practices. When users engage in transactions or store sensitive information, PadiePal utilizes end-to-end encryption, which ensures that data is protected at all stages of transmission. This level of encryption renders unauthorized access nearly impossible, thereby providing users with peace of mind regarding the security of their financial information.

Moreover, PadiePal incorporates effective fraud detection mechanisms that continuously monitor user activities for any unusual behaviors. The system employs machine learning algorithms to identify and flag transactions that deviate from a user’s typical banking patterns. This proactive approach is crucial, as it allows for immediate responses to potential threats, thus minimizing the risk of financial loss. Additionally, when a suspicious activity is detected, users are promptly notified, enabling them to take necessary actions to secure their accounts.

Data privacy policies also play a significant role in ensuring security within PadiePal. The company adheres to stringent regulatory requirements and best practices in data handling, ensuring that users’ personal and financial information is not only stored securely but also used responsibly. Users can rest assured that their information will not be shared with unauthorized third parties and will only be accessed in compliance with legal standards.

However, users also bear responsibility for maintaining their account security. It is essential for users to adopt good security practices, such as using strong, unique passwords and enabling two-factor authentication. By actively participating in their own security measures, users can further reinforce the protective mechanisms PadiePal has implemented, creating a more secure banking environment overall.

Future of PadiePal and Neo Banking Trends

The future of neo banking presents numerous opportunities and challenges, and PadiePal is poised to navigate this dynamic landscape effectively. As the demand for digital financial services continues to rise, particularly among tech-savvy consumers, PadiePal plans to integrate innovative features that cater to the evolving needs of its user base. One of the anticipated developments is the expansion of its product offerings, including enhanced savings and investment tools, as well as personalized financial advisory services driven by advanced analytics.

Market expansion is another critical focus for PadiePal. The company is exploring partnerships and collaborations that will strengthen its position in various international markets. By leveraging its existing technology and customer base, PadiePal aims to broaden its reach while ensuring compliance with local regulations. This strategic approach not only enhances the brand’s reputation but also fosters trust among potential customers in different regions.

Moreover, the role of emerging technologies such as artificial intelligence (AI) and blockchain is pivotal in shaping the future of neo banking. AI can significantly enhance user experience by providing tailored solutions and automating customer support through chatbots and machine learning algorithms. This will streamline operations and allow clients to receive real-time insights into their financial health.

Furthermore, blockchain technology presents a transformative opportunity for secure, transparent transactions. PadiePal is exploring how blockchain can be utilized to facilitate faster cross-border payments and reduce transaction fees, ultimately making banking more efficient for its users. The integration of these technologies not only positions PadiePal as a forward-thinking player in the neo banking sector but also ensures that it remains adaptable to future advancements and market demands.

Getting Started with PadiePal

To embark on your neo banking journey with PadiePal, it is essential to understand the registration process clearly. First and foremost, visit the official PadiePal website or download the mobile application available for both iOS and Android devices. Once you access the platform, initiate the sign-up process by selecting the “Register” option.

During registration, you will be prompted to provide personal information such as your full name, email address, and phone number. Ensure that the email address linked to your account is not previously associated with another PadiePal account, as this will hinder your registration. After filling in the required fields, you will receive an email verification link. Click on this link to confirm your email address, ensuring that your account is activated successfully.

Next, you will need to complete the identity verification process. This typically includes uploading government-issued identification documents such as a passport or driver’s license and providing a recent utility bill or bank statement for proof of address. PadiePal places a strong emphasis on security, and these steps are crucial for complying with regulatory requirements and protecting your financial information.

Once your documents are verified and approved, which may take a few hours to a couple of days, you will have access to your new PadiePal account. At this point, you can set up additional features such as linking your existing bank accounts or adding funds to your PadiePal wallet using various payment methods.

To maximize the benefits of PadiePal, take the time to explore its features, such as the budgeting tools and seamless transaction capabilities. Regularly check for updates and new features, as the platform is constantly evolving to improve user experience. By following these steps and engaging with the available resources, you will be well-equipped to take full advantage of PadiePal’s services.